Advertisements

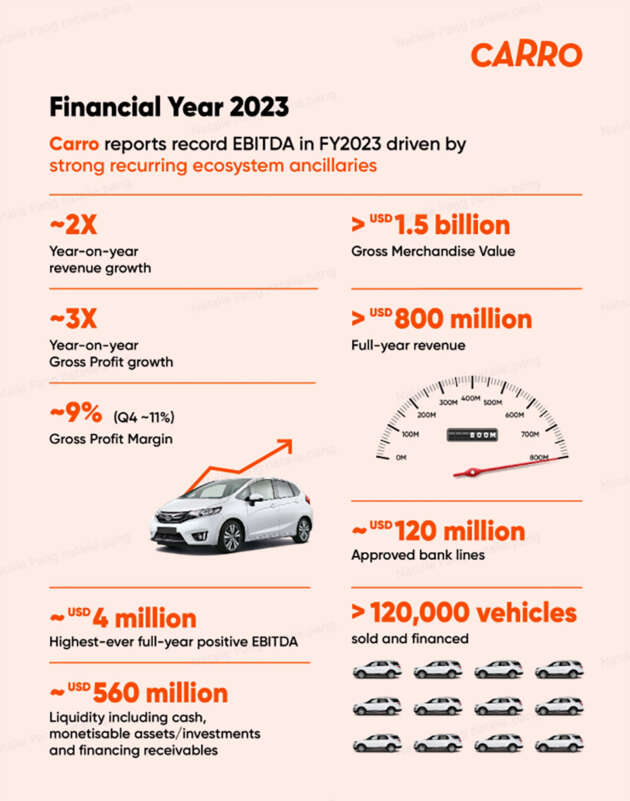

How exactly does Carro make money, and how much? Carro sold and financed over 120,000 vehicles across Indonesia, Thailand, Malaysia and Singapore. FY2023 Gross Profit Margin increased to 9%, with the final quarter ending on a high note with a GPM of 11%, more than doubling FY2022’s GPM.

This is underpinned by strong ancillary income growth, which represents close to 60% of Carro’s Gross Profit in the final quarter. Genie, Carro’s fintech business, also recorded strong growth across the region and kept non-performing loans (NPL) at 0.2%.

Indeed, the rules of the automotive industry even applies to tech unicorns. You know what they say about dealerships, that selling cars aren’t really their bread and butter, but the real money is made with all the supporting services like aftersales, insurance, and car financing.

Carro has invested in building and promoting its aftersales capabilities. For example, in Malaysia myTukar are currently running a promo where you can get 30% off its full car repainting service at its body and paint centres. You can get your car repainted in 4 days or you’ll be compensated with 50% off your bill if they are late.

Advertisements

Basically, even if you are not at the point of your life where you want to buy a car or trade in/sell your car, Carro can still get you to be their customer, because everyone has to maintain their cars, renew their insurance, and so on.

VIDEO: A happy Perodua Myvi owner gets her car repainted by MyTukar

At the moment, Carro is highly liquid, with US$560 million in its warchest comprising of cash, monetisable assets/investments and financing receivables. It also has another US$120 million in undrawn approved bank lines.

Carro uses bank lines for its Genie business. It borrows at a low fixed rate, and then dispenses loans under the Genie business at a high fixed rate as well, so it isn’t affected by fluctuating interest rates. The profit margin is the difference between the two rates. Using AI and data, it is able to keep its NPL low.

Genie’s current loan book is currently over US$350 million and it is earning interest on that loan book. This means that Carro is not just an auto tech company, it is fintech as well.

While Carro has plenty in the bank and its finances are doing well, its main competitor Carsome